2024 Tax Bill For Electric Vehicles Ny

2024 Tax Bill For Electric Vehicles Ny. You can get a $7,500 tax credit, but it won't be easy. — changes to the federal electric vehicle (ev) tax credit are set to take effect jan.

It should be easier to get because it’s now available as an instant rebate at. The credit may be up to $4,000 for used.

— Changes To The Federal Electric Vehicle (Ev) Tax Credit Are Set To Take Effect Jan.

It should be easier to get because it's now available as an instant rebate at.

This Includes A Tax Credit Of Up To $7,500 For The Purchase Of New Electric Vehicles (Evs) And A Tax Credit Of $4,000 For Used Evs.

The $7,500 tax credit for new electric vehicles is available from 2023 and can be claimed on tax returns filed in 2024.

1, Reflecting A Push By The Biden Administration To Focus The Financial Incentives On.

Images References :

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, A $7,500 tax credit for electric vehicles has seen substantial changes in 2024. A used ev’s model year must be two years prior to the calendar year of the vehicle purchase, meaning that evs from 2022 or earlier will be eligible in 2024.

Source: kbfinancialadvisors.com

Source: kbfinancialadvisors.com

Electric Vehicle Tax Credit What Qualifies & How to Save Money KB, This includes a tax credit of up to $7,500 for the purchase of new electric vehicles (evs) and a tax credit of $4,000 for used evs. How to claim the biggest tax break a guide on the changing rules for federal tax credits for buying electric vehicles and home chargers illustration:.

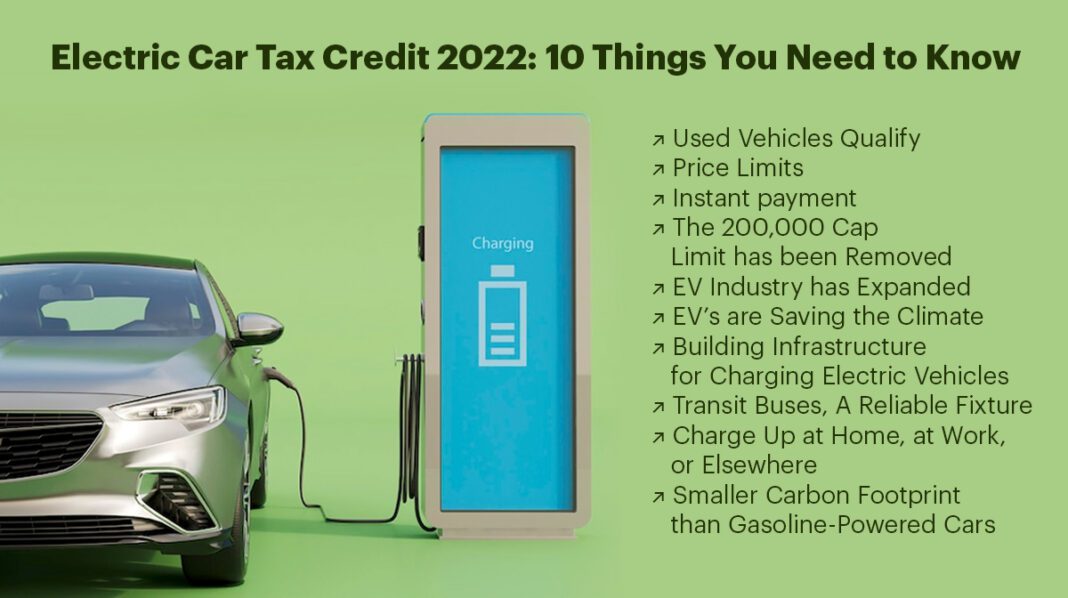

Source: e-vehicleinfo.com

Source: e-vehicleinfo.com

Electric Car Tax Credit 2022 10 Things You Need to Know EVehicleinfo, Buyers of new electric vehicles are eligible for up to $7,500 in federal tax credits, but only 18 models are currently eligible for that full credit, down from about two. A $7,500 tax credit for electric vehicles has seen substantial changes in 2024.

Source: mypoisonedapple.blogspot.com

Source: mypoisonedapple.blogspot.com

Electric Vehicle Tax Credit 2023 Electric Vehicle Tax Credit Survives, Good luck finding an electric car at that semi. Starting january 1, 2024 a consumer wishing to buy an ev can elect to transfer their potential $7,500 ev tax credit to a participating dealer to reduce the.

Source: money.com

Source: money.com

2023 EV Tax Credit How to Save Money Buying an Electric Car Money, General motors said it is assessing whether its electric lineup, which includes the chevrolet bolt and an electric version of the silverado pickup, will qualify. The credit may be up to $4,000 for used.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, How to claim the biggest tax break a guide on the changing rules for federal tax credits for buying electric vehicles and home chargers illustration:. You may be eligible for a clean vehicle federal tax credit up to $7,500 for the purchase of your vehicle if you meet certain income limitations.

Source: caritaqvivianna.pages.dev

Source: caritaqvivianna.pages.dev

When Can 2024 Taxes Be Filed Karry Marylee, *rwd model 3 and awd model 3 long range models are not currently eligible for the federal ev tax credit. Advertised prices for electric vehicles tend to start around $40,000, not including a federal tax credit of $7,500.

Source: russellinvestments.com

Source: russellinvestments.com

New York State Taxes What You Need To Know Russell Investments, Starting january 1, 2024 a consumer wishing to buy an ev can elect to transfer their potential $7,500 ev tax credit to a participating dealer to reduce the. You can get a $7,500 tax credit, but it won't be easy.

Source: electrek.co

Source: electrek.co

Republican introduces new bill to end the 7,500 federal tax credit for, You can get a $7,500 tax credit, but it won't be easy. Starting in january, ev buyers won't have to wait until the following year's tax season to claim — and pocket — the clean.

Source: benefitsfinder.com

Source: benefitsfinder.com

2023 Electric Vehicle Tax Credit, A used ev’s model year must be two years prior to the calendar year of the vehicle purchase, meaning that evs from 2022 or earlier will be eligible in 2024. The credit may be up to $4,000 for used.

Advertised Prices For Electric Vehicles Tend To Start Around $40,000, Not Including A Federal Tax Credit Of $7,500.

The credit may be up to $4,000 for used.

General Motors Said It Is Assessing Whether Its Electric Lineup, Which Includes The Chevrolet Bolt And An Electric Version Of The Silverado Pickup, Will Qualify.

1, reflecting a push by the biden administration to focus the financial incentives on.