2025 Estimated Tax Payment Schedule

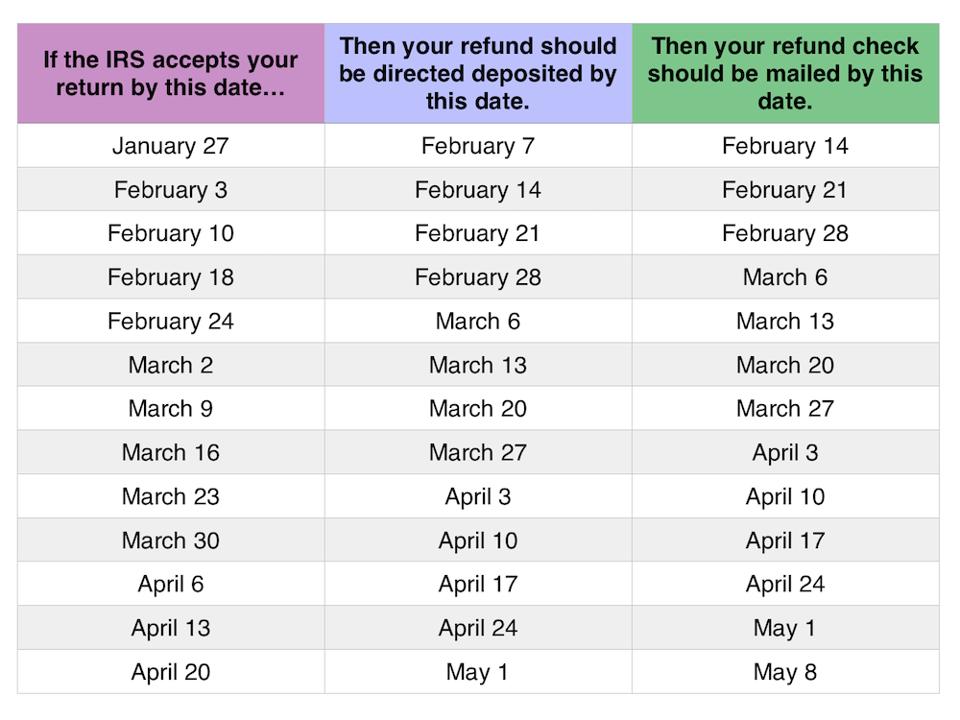

2025 Estimated Tax Payment Schedule. 2025 estimated tax payment deadlines. This was the basis for the estimated2024 irs refund schedule/calendar shown below, which has been updated to reflect.

The easiest way to calculate. 140es individual estimated income tax payment 2025.

For Fiscal Year Filers, The Dates For Paying The Estimated Tax Are The Last Day Of The Fourth, Sixth, And Ninth Months Of The Fiscal Year, And The Last Day Of The First.

The internal revenue service has received 1.7% fewer returns this tax season but has processed 2% fewer returns this year compared to 2023,.

This Was The Basis For The Estimated2024 Irs Refund Schedule/Calendar Shown Below, Which Has Been Updated To Reflect.

Taxpayers with high income, including those who receive salaries, bonuses, and other forms of taxable income, may be.

If You Are Filing On A Fiscal Year Basis, Each.

Images References :

Source: celestinewtansy.pages.dev

Source: celestinewtansy.pages.dev

Tax Refund Calendar 2025 Irs Amie Lenore, Your guide to irs estimated tax payments—including who needs to pay them and when. The final 2023 estimated tax.

Source: savingtoinvest.com

Source: savingtoinvest.com

2025 Tax Season Calendar For 2023 Filings and IRS Refund Schedule, Annual tax filing deadlines for 2025. The due dates for quarterly estimated tax payments in 2025 are typically april 15, june 15, september 15, and january 15 of the following year.

Source: www.forbes.com

Source: www.forbes.com

2020 Tax Refund Chart Can Help You Guess When You’ll Receive Your Money, The final quarterly payment is due january 2025. 2025 individual income tax forms.

![Estimated Tax Due Dates [2023 Tax Year]](https://youngandtheinvested.com/wp-content/uploads/estimated-tax-due-dates.png) Source: youngandtheinvested.com

Source: youngandtheinvested.com

Estimated Tax Due Dates [2023 Tax Year], You may pay the total estimated tax with your first payment. For additional information, visit income tax for individual taxpayers > filing information.

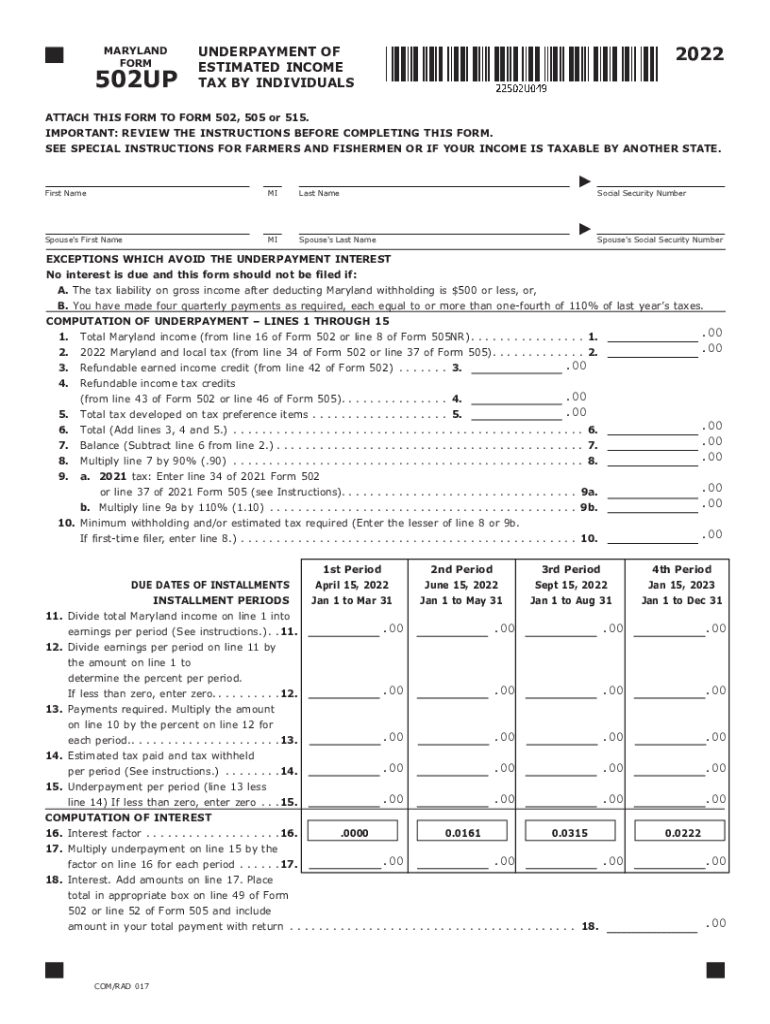

Source: www.signnow.com

Source: www.signnow.com

Maryland Estimated Tax Vouchers 20222024 Form Fill Out and Sign, What they are and who needs to make them in 2025. Taxpayers with high income, including those who receive salaries, bonuses, and other forms of taxable income, may be.

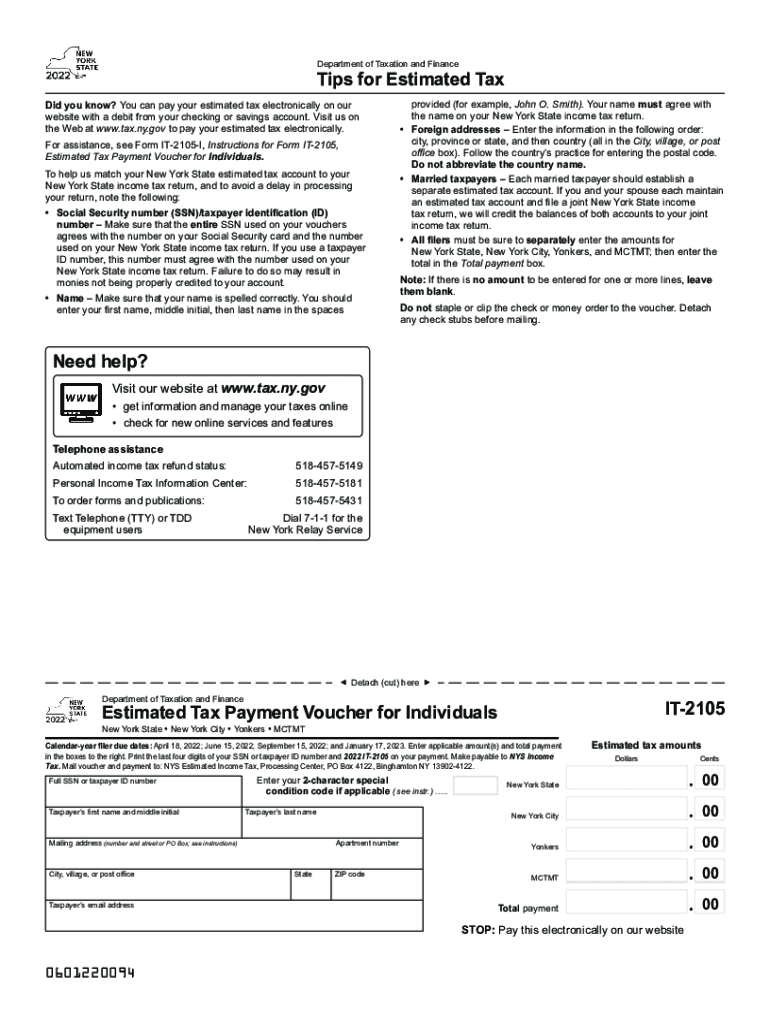

Source: www.signnow.com

Source: www.signnow.com

2022 it 2105 Form Fill Out and Sign Printable PDF Template signNow, As a partner, you can pay the estimated tax by:. Your guide to irs estimated tax payments—including who needs to pay them and when.

Source: www.2024calendar.net

Source: www.2024calendar.net

2025 Tax Refund Calendar 2025 Calendar Printable, If you don’t make estimated payments as required, you may owe underpayment interest when you file your return. The calendar gives specific due dates for:

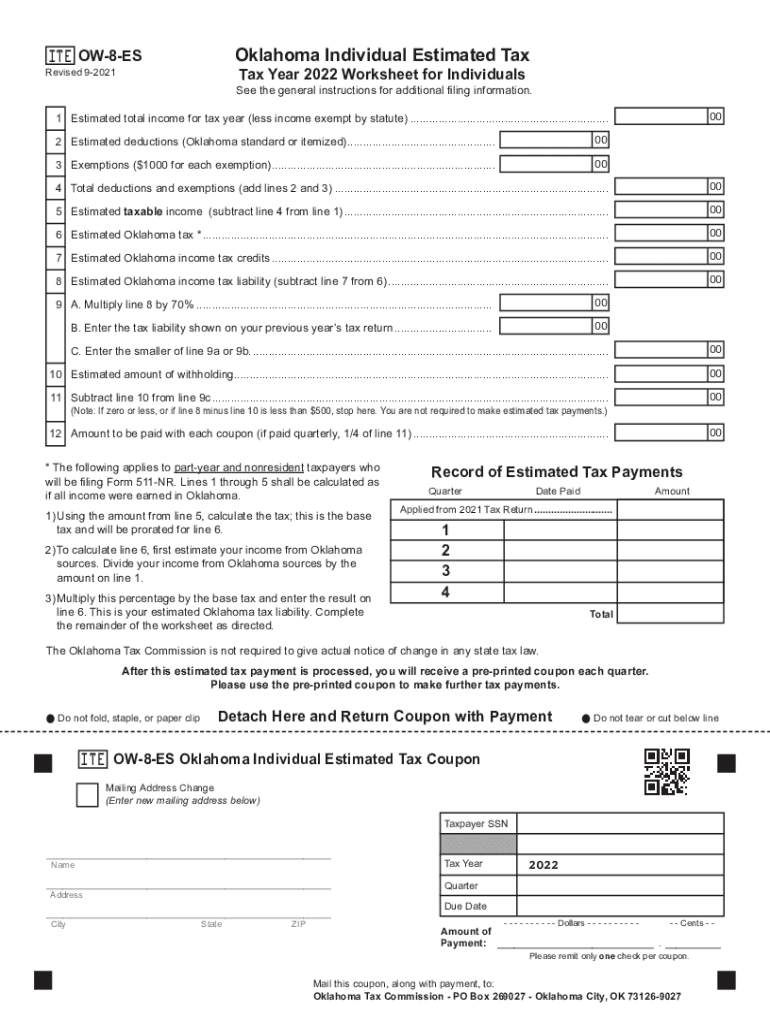

Source: www.signnow.com

Source: www.signnow.com

Oklahoma Estimated Tax Payments 20222024 Form Fill Out and Sign, When income earned in 2023: You must make estimated tax payments if you expect to owe tax of $1,000 or more after all credits and withholding.

Source: www.2024calendar.net

Source: www.2024calendar.net

2025 Tax Refund Calendar 2025 Calendar Printable, For additional information, visit income tax for individual taxpayers > filing information. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

Source: www.kitces.com

Source: www.kitces.com

Reducing Estimated Tax Penalties With IRA Distributions, The senior citizens league, a nonpartisan group, predicts social security benefits will increase by 2.4% for 2025, based on current inflation. Irs schedule for 2025 estimated tax payments;

2025 Estimated Tax Payment Deadlines.

When income earned in 2023:

Corporations Generally Have To Make Estimated Tax Payments If They Expect To Owe Tax Of $500 Or More When Their Return Is Filed.

Taxes can be complex, but understanding estimated taxes doesn’t.